October 2012 CD Rate Update

October 16th, 2012

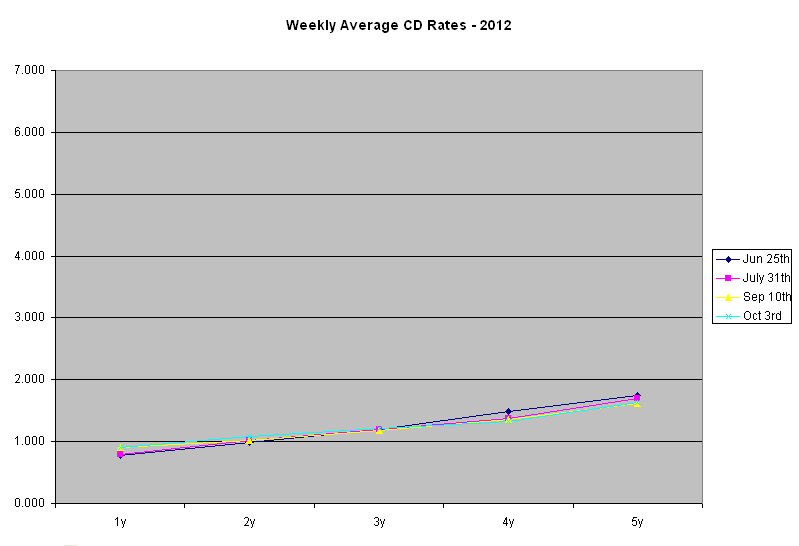

I have updated our average CD Rate graph, adding the week of October 3rd, 2012. I surveyed the top 30 banks and credit unions that are available in the national market. In the last post, I picked on the credit unions a bit. They had no cd rates in the top 10 on a 1-year CD. They still don’t. However, there are 6 credit unions in the top 10 on a 5-year CD.

1-Year CD Rates remain almost the same

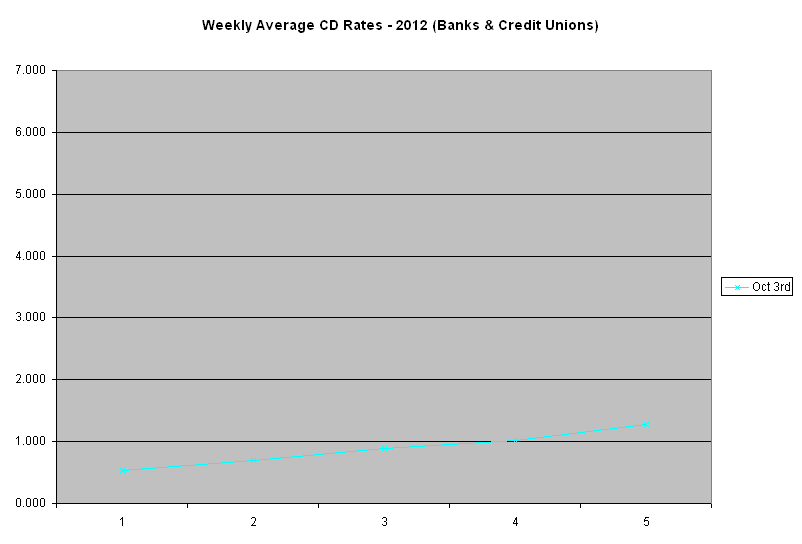

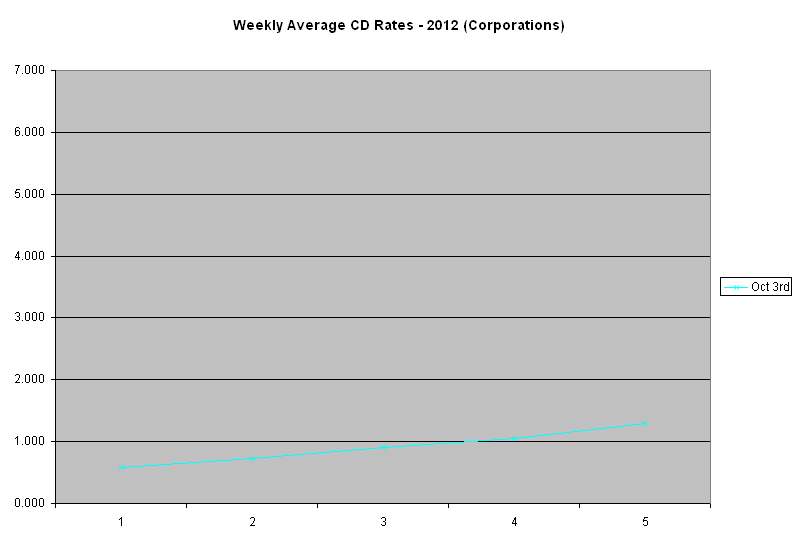

The average rate for September 10th was 0.902. For October 3rd it is 0.903. Hardly a difference. There are 10 Banks above 1.00% for retail deposits. As promised I will also begin providing a graph for average rates that are available for institutional and corporate investors. There is quite a gap between the retail and institutional. The average 1-year rate available for other banks and credit unions was 0.532% and for corporations it was 0.587%. Like the retail rates, this is for the top 30 banks and credit unions available in the national market.

Long-Term vs. Short-Term

Another blog posted an article comparing the highest savings rates to the average 5-year CD Rates. I kindly pointed out that in order for the article to be fair, they would need to either compare both of the highest or both averages. Manipulating data to prove a bias does not score big points in my book. Even us using the top 30 rates could be construed as not realistic. Some would argue we aren’t looking at the whole market so the average is skewed high. However, how many people have enough money to have to worry about looking for that many banks or credit unions? In their mind it may be skewed low.

The 2-year, 3-year, and 5-year averages all moved up for the first week of October. My personal opinion is this is a short-term blip. In general there is still too much liquidity at the banks and they don’t need to compete for deposits. We hear this a lot when looking for banks for our institutional clients.

There is still a premium on the long-term CDs. The average 5-year is 1.63% for retail and 1.27% for credit union and bank investors. This compares to a 1-year at 0.903% for the retail and 0.53% for the banks and credit unions. Given that the Fed has indicated they will be holding rates low until 2015, I believe you can add some long-term CDs without losing much in the way of opportunity cost.

If you find a good deal, let us know. Happy searching.

cd :O)

-- By Chris Duncan